Economic update for the week ending June 19, 2021

Stock markets dropped this week – Stock markets dropped following comments by Federal Reserve which were issued after their monetary policy meeting this week. In their comments they recognized that inflation is picking up at a faster rate than they had estimated. They said that they anticipated bringing rates above the 0% rate they dropped them to in the depths of the pandemic by making two rate hikes in 2023. Investors also drew the conclusion that even though they were not committing to rate hikes until 2023, they may take other tightening measures to keep the economy from overheating. Those include reducing bond purchases and other actions to tighten the money supply. The Dow Jones Industrial Average closed the week at 33,290.08, down 3.4% from 34,479.60 last week. It is up 8.7% year-to-date. The S&P 500 closed the week at 4,166.45, down 1.9% from 4,247.44 last week. It is up 10.9% year-to-date. The NASDAQ closed the week at 14,030.38, down 0.3% from 14,069.42 last week. It is up 8.9% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 1.45%, down slightly from 1.47% last week. The 30-year treasury bond yield ended the week at 2.01%, down from 2.15% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – The June 17, 2021, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate was 2.93%, down slightly from 2.96% last week. The 15-year fixed was 2.24%, almost unchanged from 2.23% last week. The 5-year ARM was 2.52%, down slightly from 2.55% last week.

California home prices reach a new all-time high again in May – The California Association of Realtors reported that existing home sales totaled 445,680 on a seasonally adjusted annualized rate in May. That marked a month-over-month decrease of 2.7% from the near record number of homes sold in April. Year-over-year the number of sales were up 86.7% from last May when home sales ground to a halt due to the pandemic. The median price paid for an existing home in May was $818,260, up from April’s $813,980 median price. Year-over-year the median price increased 39.1% from last May when the median price was $588,070. May marked the highest year-over year gain in prices ever recorded, and the second straight month of year-over-year gains of over 30% in the median price, also a record. The California Association of Realtors tracks inventory levels based on how many months it would take to sell the active listings in all MLS systems at the current sales level. There was a 1.8 month supply of homes for sale in May, up from 1.6 months in April. There was a 3.2 month supply of homes for sale last May. The average 30-year fixed mortgage rate in May was 2.96%,down from 3.16% in May 2020

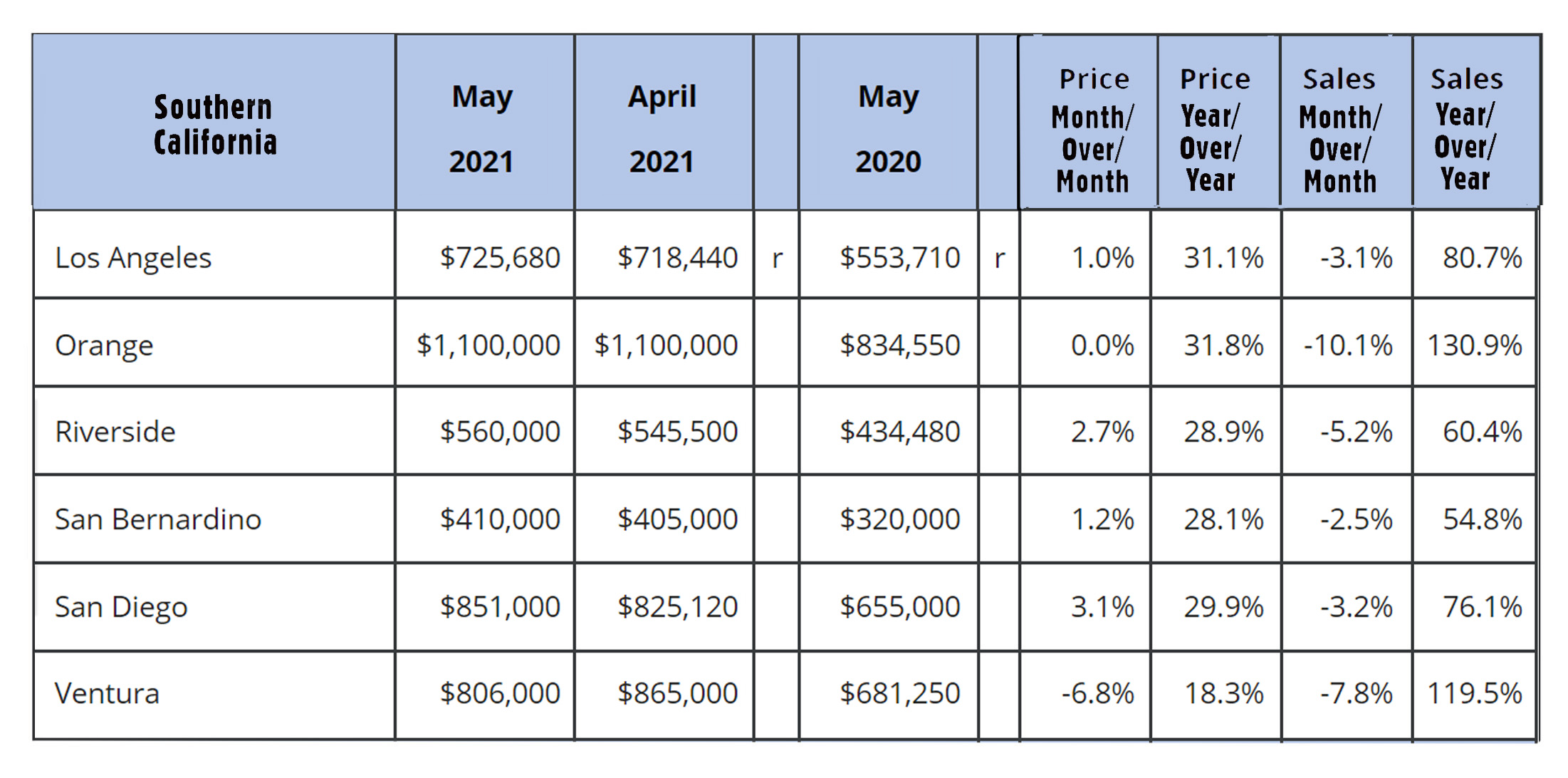

Below are median price and sales data by county.